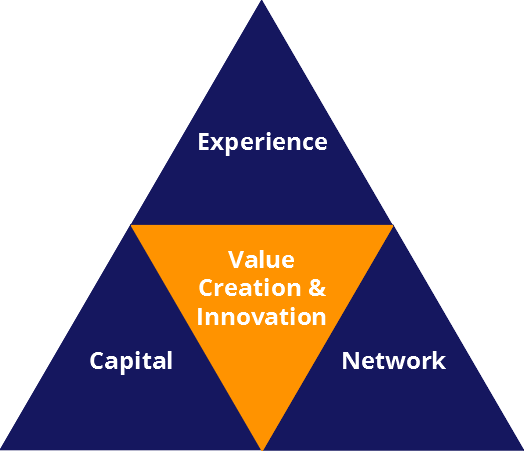

WHY

We believe that the association of intellectual capital and professional network can leverage capital towards better returns in the long run.

Doing this with partners that share a set of values and principles and that have developed common trust along decades of knowing each other and working together is our most important asset.

WHAT

We invest in private companies in developing stages, both in Brazil and abroad, which hold a high growth potential leveraged by technology and innovation.

We focus on minority investments, are agnostic in our investment thesis and aim at businesses that have validated product fit, proven go-to-market strategy and are already generating revenue.

We look for outstanding entrepreneurs that are interested to capitalize on our experience and network.

We seek extraordinary companies that:

WHO

We are former partners of Accenture, joined by a former CEO of Pepsico Beverages South America, with more than two hundred years of accumulated business experience and personal capital investments.

Carlos

Pedranzini

Partner

Francisco

A. Ribeiro

Partner

Giancarlo

Berry

Partner

Heron

Abi-Sâmara

Partner

Mario

Fleck

Partner

Roger

Ingold

Partner

Vasco

Luce

Partner

André

Cruz

Partner

HOW

We have developed our own methodology for originating, studying and contracting investments based on the sum of our individual professional experiences. Our methodology focuses on understanding the business and the value it can provide to its customers, founders and other stakeholders.

-

01Diligent SelectionWe are extremely diligent when selecting companies and consider quality to be more important than timing.

-

02Structured AssessmentAll opportunities undergo a structured screening process with the direct participation of all partners and a detailed assessment involving investment thesis, business case, operational & financial status, customer satisfaction, as well as investors’ profile.

-

03Value AddedWe will proactively participate in investment opportunities, by adding value with strategy, management and promoting the invested companies through our network.

PORTFOLIO COMPANIES

We invest in promising companies driven by exceptional founders that are building disruptive businesses to capture relevant market opportunities

WHERE

We are based in São Paulo and have strong network in the US, Latin America, Europe and Israel.

Jardim Paulistano, São Paulo – SP 01455-000

contato@acnext.com